FHSA vs. RRSP: Understanding Your First-Time Home Buyer Savings Options

Buying your first home is exciting, but also financially challenging. To support first-time buyers, the Canadian government offers tax-advantaged savings tools. Two of the most popular options are the Registered Retirement Savings Plan (RRSP) with the Home Buyers’ Plan (HBP) and the First Home Savings Account (FHSA). Both accounts help you save faster, but they work differently. Here’s a clear comparison to help you decide which fits your situation best.

What Is an RRSP with the Home Buyers’ Plan?

An RRSP is primarily designed for retirement savings. However, under the Home Buyers’ Plan (HBP), first-time buyers can withdraw up to $60,000 from their RRSP tax-free to buy a qualifying home. Couples can combine withdrawals for up to $120,000.You must repay the withdrawn amount back into your RRSP within 15 years. If you skip a repayment, that year’s amount is added to your taxable income. Pros of the RRSP HBP:- Large withdrawal limit ($60,000 per person).

- Contributions are tax-deductible, reducing taxable income.

- Flexible use of funds for the down payment or closing costs.

- Repayment is mandatory.

- Withdrawn funds lose the chance to grow tax-sheltered for retirement.

- You must have savings already in your RRSP before using the HBP.

What Is a First Home Savings Account (FHSA)?

The FHSA is a newer savings tool created specifically for first-time buyers. It combines the best features of an RRSP and a TFSA. You can contribute up to $8,000 per year, with a lifetime limit of $40,000.Contributions are tax-deductible, just like an RRSP. Withdrawals for your first home purchase are tax-free, just like a TFSA. If you don’t use the FHSA within 15 years, you can transfer the funds to your RRSP or RRIF without penalty. Pros of the FHSA:- Tax-deductible contributions.

- Tax-free withdrawals for your first home.

- No repayment required.

- Can be combined with the RRSP HBP for even more savings.

- Annual contribution limit of $8,000.

- Lifetime maximum of $40,000 may not cover large down payments.

- Must be a first-time buyer to qualify.

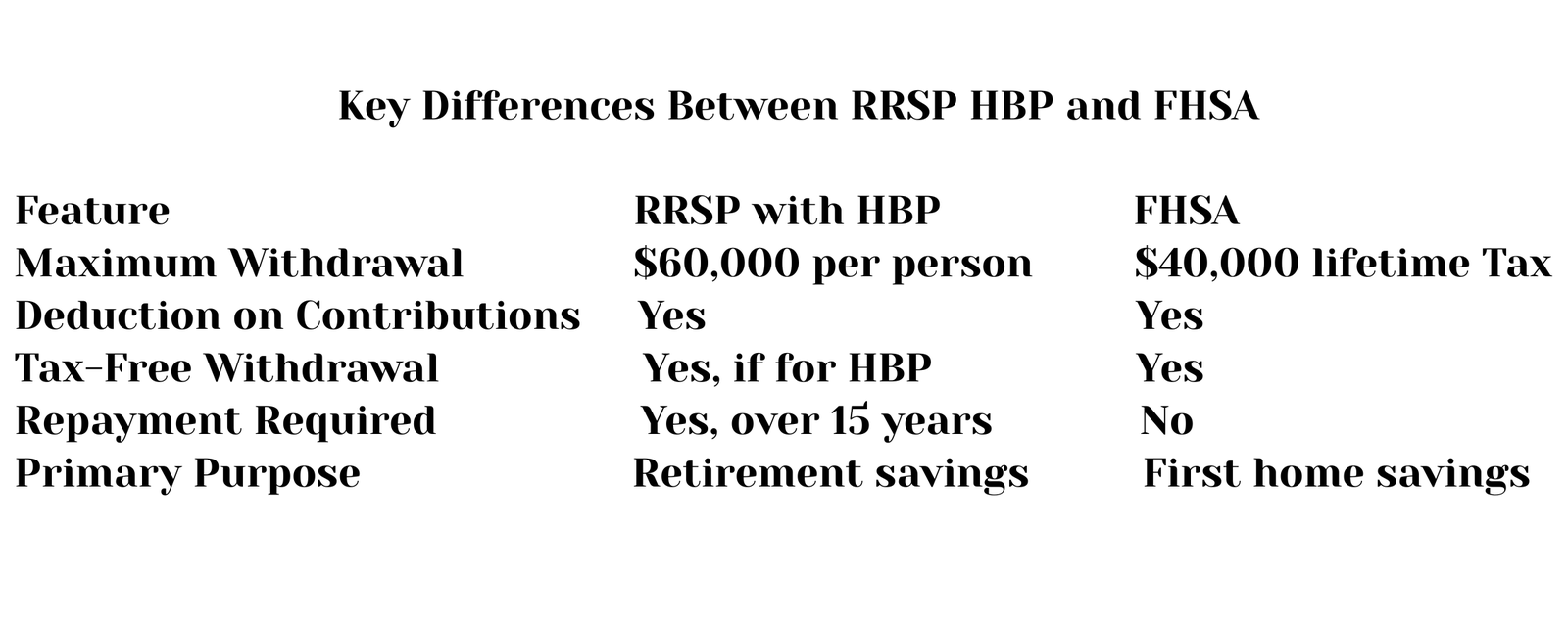

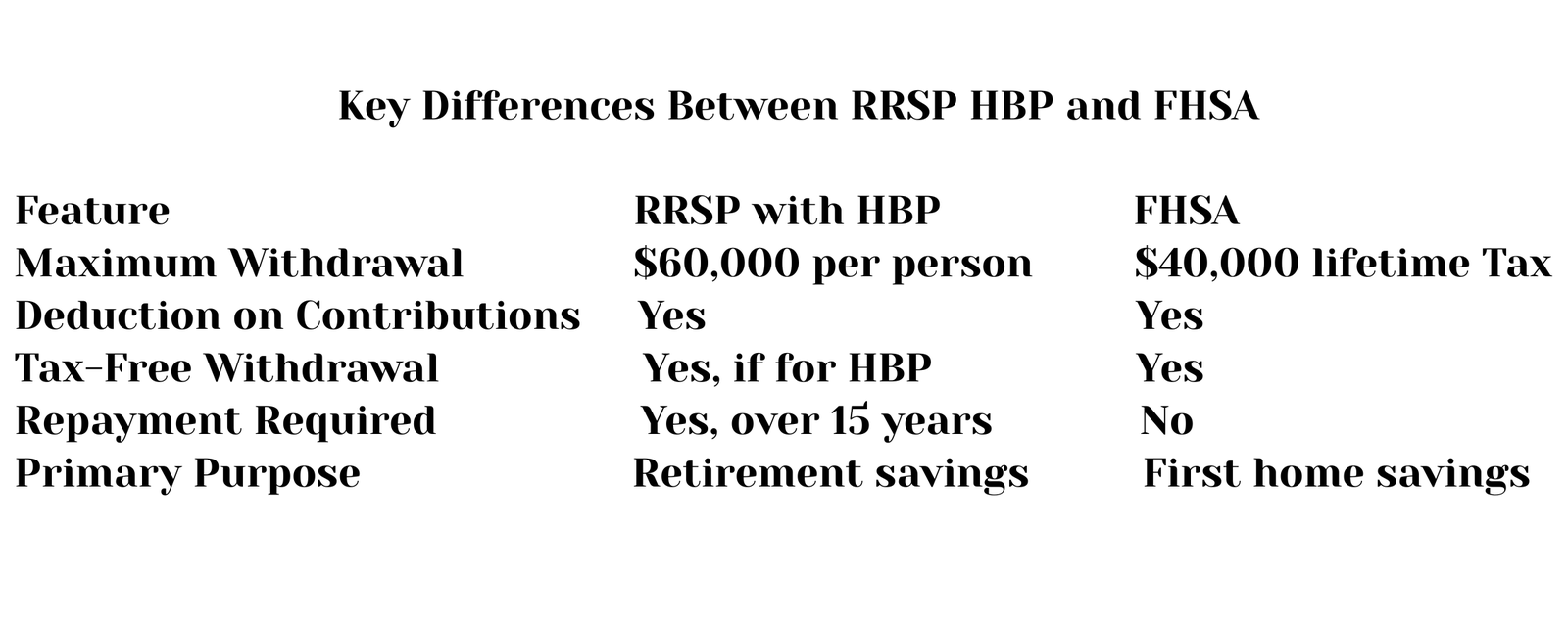

Key Differences Between RRSP HBP and FHSA